The Secret Strategic Advantage of Private Equity

The Secret Strategic Advantage of Private Equity

Private equity firms have become increasingly popular due to their reputation for boosting the value of their investments. They are known for achieving high returns through a number of factors, including high-powered incentives for portfolio and operating managers, the aggressive use of debt for financing and tax advantages, and a focus on cash flow and margin improvement. Another key factor is the freedom from restrictive public company regulations.

While private equity firms typically focus on buying businesses with the intention of selling them for a profit, a strategy of flexible ownership could have wider appeal to large industrial and service companies. Under this approach, a company holds onto businesses for as long as it can add significant value by improving their performance and fueling growth. The company is equally willing to dispose of those businesses once it is no longer adding value. This approach allows companies to hold onto an acquired business, giving them a potential advantage over private equity firms.

Consider Joining our FREE community Discord server at: https://discord.com/invite/pmpWcHs

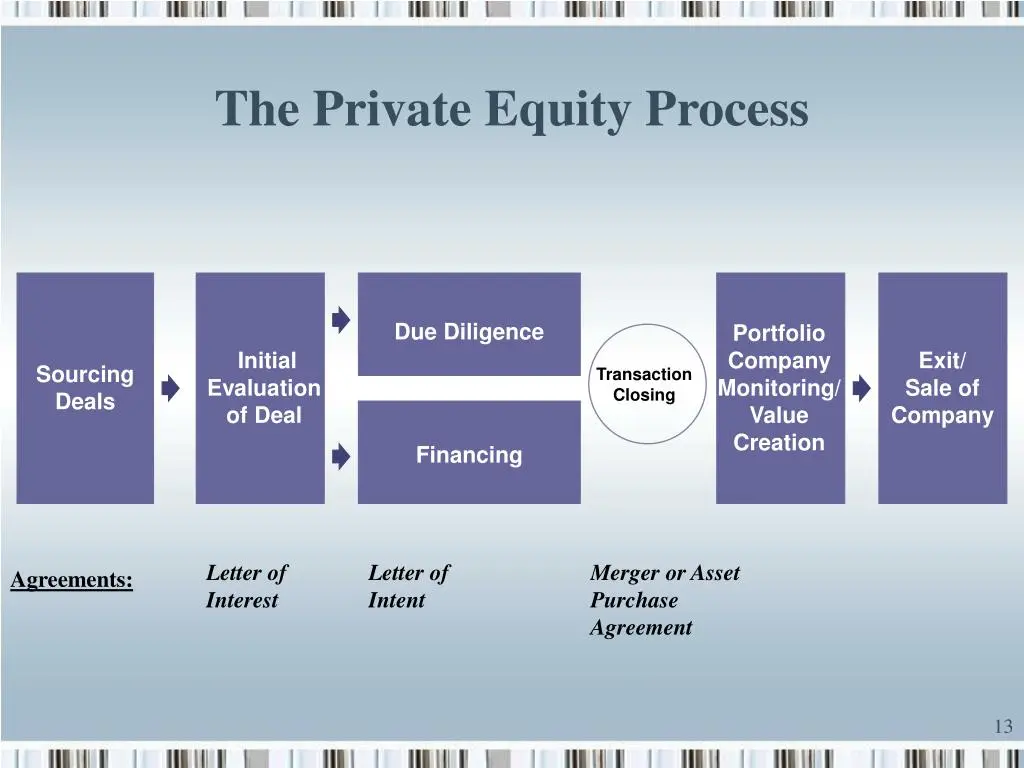

Private equity firms devote a significant amount of time and resources to proactively screening potential targets. Their managers typically come from investment banking or strategy consulting backgrounds, and often have line business experience as well. They use their extensive networks of business and financial connections to find new deals and their skill at predicting cash flows allows them to work with high leverage but acceptable risk. If a public company is considering a buy-to-sell strategy, it needs to assess its capabilities in these areas and determine whether they could be acquired or developed.

Make sure to check out our store at: https://ethanwrenn.com/shop/

Private equity firms are also skilled at managing an M&A pipeline, with a strong understanding of how many targets they need to evaluate for every bid and the probability that a bid will succeed. They have disciplined processes that prevent them from raising bids just to achieve an annual goal for investing in deals. Additionally, they have developed exit strategies for each business during the acquisition process and are skilled at finding buyers willing to pay a good price or launching successful IPOs. A public company needs to assess not only its ability but also its willingness to become an expert at shedding healthy businesses.

While private equity firms typically focus on buying to sell, a few public companies, such as Berkshire Hathaway, seek to create shareholder value by making smart investment decisions. Unlike private equity firms, they buy to keep. However, even successful companies like Berkshire Hathaway acknowledge that buying to keep can hurt financial performance. For Berkshire’s businesses to be good investments, they have to beat the market not just for five or ten years, but forever. This is a tall order, even for a company like Berkshire Hathaway.

Read more articles like this by checking out our blog page: https://ethanwrenn.com/blog/

-

Rated 5.00 out of 5 based on 1 customer rating$50.00

-

Rated 5.00 out of 5 based on 1 customer rating$50.00

-

Rated 5.00 out of 5 based on 1 customer rating$5.00 – $9.00

-

Rated 5.00 out of 5 based on 1 customer rating$95.00

-

Rated 5.00 out of 5 based on 1 customer rating$55.00

-

Rated 5.00 out of 5 based on 1 customer rating$5.00 – $9.00

-

Rated 5.00 out of 5 based on 1 customer rating$95.00

-

Rated 5.00 out of 5 based on 1 customer rating$55.00

-

Rated 5.00 out of 5 based on 1 customer rating$5.00 – $9.00

-

Rated 3.50 out of 5 based on 2 customer ratings$5.00 – $9.00

Wrenn Apparel is a fashion-forward brand that offers a wide range of high-quality clothing and accessories for men and women. With a focus on style, comfort, and sustainability, Wrenn Apparel offers everything from casual wear to office attire. Whether you’re looking for a stylish and comfortable outfit for the weekend or a professional look for the office, Wrenn Apparel has something for everyone. Shop now and experience the difference that Wrenn Apparel’s commitment to quality and style can make in your wardrobe.

Mapping Potential Portfolio Strategies

Private equity firms are known for their ability to increase the value of their investments dramatically. They use a variety of strategies to achieve high returns, including the use of debt financing, a focus on cash flow and margin improvement, and flexible ownership approaches. However, before they can begin implementing these strategies, private equity firms must first map out a potential portfolio strategy.

Mapping a potential portfolio strategy involves identifying the types of investments that are most likely to provide the highest returns. Private equity firms typically start by screening dozens of potential targets, using their extensive networks of business and financial connections to find new deals. They then evaluate each potential target based on a range of criteria, such as the company’s financial performance, growth potential, and competitive landscape.

Consider Joining our FREE community Discord server at: https://discord.com/invite/pmpWcHs

One key factor that private equity firms consider when mapping out a potential portfolio strategy is the industry in which the target company operates. Some industries are more attractive than others, either because they are growing rapidly or because they are in the midst of significant change. For example, private equity firms may focus on industries such as technology, healthcare, or renewable energy, which are all experiencing rapid growth and offer significant potential for investment returns.

Another factor that private equity firms consider when mapping out a potential portfolio strategy is the size of the target company. Generally speaking, private equity firms prefer to invest in companies that are smaller and have significant growth potential. These companies often have more room to grow and can benefit from the operational expertise and resources that private equity firms bring to the table.

In addition to industry and company size, private equity firms also consider other factors when mapping out a potential portfolio strategy. For example, they may look at the company’s existing management team, the competitive landscape, and the potential for operational improvements. They may also consider the potential for synergies between the target company and other investments in their portfolio.

Once private equity firms have identified a potential portfolio strategy, they begin to develop a detailed plan for how they will add value to each individual investment. This plan typically includes specific goals and targets for revenue growth, margin improvement, and other key performance indicators. Private equity firms then work closely with the management teams of each investment to implement these plans and achieve their goals.

One advantage that private equity firms have over other types of investors is their ability to be flexible in their ownership approach. Private equity firms are equally willing to hold on to businesses for as long as they can add significant value by improving their performance and fueling growth. They are also willing to dispose of those businesses once that is no longer clearly the case. This approach allows private equity firms to maximize returns and create significant value for their investors.

In conclusion, mapping a potential portfolio strategy is a critical first step for private equity firms. By carefully evaluating potential targets and developing a detailed plan for adding value, private equity firms are able to achieve high returns and create significant value for their investors. Through their extensive networks, operational expertise, and flexible ownership approach, private equity firms are well-positioned to continue delivering strong results for years to come.

That Time We Shorted (COIN) CoinBase Global, Inc. – Live Technical Analysis, Trade Recap

Coinbase is a digital currency exchange platform that allows users to buy, sell, and store cryptocurrencies. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam and has since become one of the...

Read MoreThe Unbelievable History of (IDU) iShares U.S. Utilities ETF

In the dynamic world of investment, few sectors have exhibited the resilience and stability of the utilities sector. Amidst economic fluctuations and market turbulence, the iShares U.S. Utilities ETF (IDU) has stood as a steadfast...

Read MoreWhat is Margin Trading

Margin trading is an advanced trading strategy that allows investors to borrow funds to buy securities. With this approach, investors can increase their buying power and potentially generate higher returns than traditional trading methods. Margin trading is a powerful tool that can magnify profits, but it also carries significant risks, including the potential for losses that exceed the initial investment.

Margin trading works by allowing investors to borrow funds from their broker to purchase securities. The amount of funds that can be borrowed depends on the investor’s margin account balance and the securities they hold in their portfolio. Margin trading also involves paying interest on the borrowed funds, which can impact the overall return on investment. However, if the securities purchased with the borrowed funds increase in value, the investor can earn a profit that exceeds the interest paid on the borrowed funds.

Margin trading is not suitable for everyone, as it requires a higher level of knowledge and experience than traditional trading methods. Investors who are considering margin trading should fully understand the risks and potential rewards before investing. They should also have a solid understanding of the securities they are trading and the market conditions that can impact their investments. Investors should also be prepared to monitor their margin account regularly, as market fluctuations can impact the value of their investments and the amount of margin required.

Overall, margin trading can be a powerful tool for experienced investors who are willing to take on additional risks to potentially generate higher returns. With careful planning and a thorough understanding of the risks involved, margin trading can be an effective strategy for achieving investment goals. It is important for investors to do their research and work with a reputable broker who can provide guidance and support in navigating the complexities of margin trading.

EthanWrenn is a YouTube channel that offers a unique blend of finance, investing, and gaming content. Hosted by Ethan, an expert in finance and investment, this channel provides valuable insights and tips on how to navigate the world of finance and investing. But that’s not all, EthanWrenn also showcases Ethan’s passion for gaming, as he shares his thoughts and experiences playing a variety of video games. With a mix of informative and entertaining content, EthanWrenn is the perfect channel for anyone looking to learn about finance and investing or for those who simply love video games. So, if you’re ready for an entertaining and educational journey, be sure to subscribe to EthanWrenn on YouTube today! Make sure to leave a like, comment and subscribe to stay up to date with the latest information available.

Make sure to check out our merch store at:

https://ethanwrenn.com/shop/

Consider joining our FREE community Discord server at:

https://discord.com/invite/pmpWcHs

Donate using Stream Labs and have your message appear on stream by clicking here:

https://streamlabs.com/ethanwrenn

Follow me across my various social media profiles!

Website: https://ethanwrenn.com/

Twitch: https://www.twitch.tv/ethanwrenn

YouTube: https://www.youtube.com/c/EthanWrenn

Reddit Community: https://www.reddit.com/r/EthanWrenn/

Personal Reddit: https://www.reddit.com/user/EthanWrenn

LinkedIn: https://www.linkedin.com/in/EthanWrenn

Ebay: https://www.ebay.com/usr/ethanwrenn

Twitter: https://twitter.com/ethanxwrenn

Instagram: https://instagram.com/ethanxwrenn/

TikTok: https://www.tiktok.com/@ethanxwrenn

Parler: https://parler.com/ethanwrenn

Dlive: https://dlive.tv/Intellx

Periscope: https://www.periscope.tv/EthanWrenn

SnapChat: https://www.snapchat.com/add/ethannn_619

Gaming Profiles

Steam Community: https://steamcommunity.com/id/ethanwrenn

League of Legends: https://na.op.gg/summoners/na/ethanwrenn

World of Warcraft: https://worldofwarcraft.com/en-us/character/us/sargeras/int%C3%AAllx

World of Warcraft Guild: https://worldofwarcraft.com/en-us/guild/us/sargeras/wrenn

Follow the official WrennLLC social media profiles!

Website: https://wrennllc.com/

Twitch: https://www.twitch.tv/WrennLLC

Twitter: https://twitter.com/WrennLLC

Instagram: https://www.instagram.com/WrennLLC/?hl=en

Reddit Community: https://www.reddit.com/r/WrennLLC/

Business Reddit: https://www.reddit.com/user/WrennLLC

SnapChat: https://www.snapchat.com/add/WrennLLC

Q: What brokerages do you recommend?

A: The following companies offer brokerage services.

Join Robinhood today using my link to receive a FREE stock to have in your portfolio:

https://join.robinhood.com/ethanw186/

Sign up for Webull and receive 4 FREE stocks, limited time!

https://act.webull.com/te/m3fVcVFQYG41/gje/inviteUs/

CashApp is offering new users who sign up with my link $5 FREE!

https://cash.app/app/DNBFZKD

Sign up to Coinbase to receive $10 in FREE Bitcoin!

https://www.coinbase.com/join/wrenn_k

The Secret Strategic Advantage of Private Equity

Private equity firms have become increasingly popular due to their reputation for boosting the value of their investments. They are known for achieving high returns through a number of factors, including high-powered incentives for portfolio and operating managers, the aggressive use of debt for financing and tax advantages, and a focus on cash flow and margin improvement. Another key factor is the freedom from restrictive public company regulations.

Pingback: Ohio Law & Administrative Rule 1301:6-3-44 - Investment Adviser and Investment Adviser Representative Fraudulent Practices - Ethan Wrenn

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you very much for sharing, I learned a lot from your article. Very cool. Thanks.

Really appreciate you sharing this blog.Really looking forward to read more. Fantastic.